I have decided to separate the English and the Italian versions of my periodic notes into two separate posts. If you are receiving the wrong version, please let me know and I will correct the language assignment (including receiving both versions). Or, if you prefer, go to orthos.ch/blog where you can find all posts under the language of your choice.

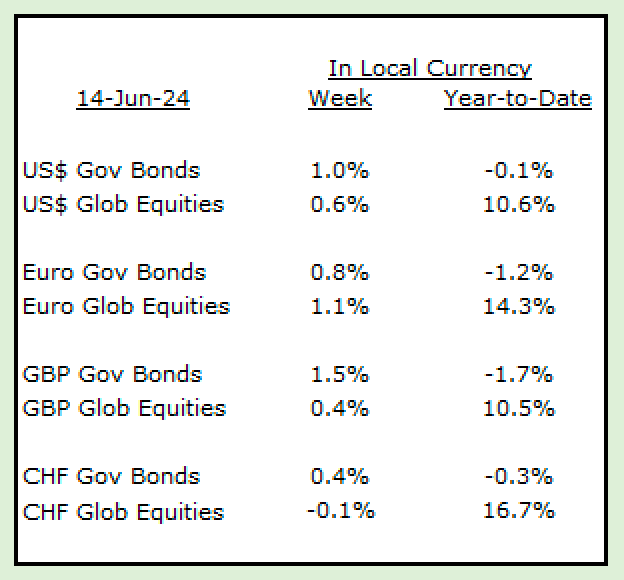

Over the past two weeks, the ECB cut interest rates whereas the Fed did not and now signals only a single move by the end of the year. This means that for the first time in quite a while we have a divergence of policies between the two major monetary authorities in the world. Each had its good reasons for their moves: in Europe, growth is sluggish, inflation is tamer, war is raging, politics is hot and China is causing a lot of headaches; in America, growth is solid, inflation is stubborn (despite the latest number), politics and legislative actions are at a standstill, justice is in question, and China looms large here too. Markets reacted positively during the two weeks, with equities especially so; the only major sector in the negative was high yield bonds, a fact which does not make much sense in the context. Essentially the recent news have not caused any major change in the minds of investors, who remain enthusiastic and motivated to take risk.

[Sources: The New York Times]

Over the past two weeks, the ECB cut interest rates whereas the Fed did not and now signals only a single move by the end of the year. This means that for the first time in quite a while we have a divergence of policies between the two major monetary authorities in the world. Each had its good reasons for their moves: in Europe, growth is sluggish, inflation is tamer, war is raging, politics is hot and China is causing a lot of headaches; in America, growth is solid, inflation is stubborn (despite the latest number), politics and legislative actions are at a standstill, justice is in question, and China looms large here too. Markets reacted positively during the two weeks, with equities especially so; the only major sector in the negative was high yield bonds, a fact which does not make much sense in the context. Essentially the recent news have not caused any major change in the minds of investors, who remain enthusiastic and motivated to take risk.

[Sources: The New York Times]